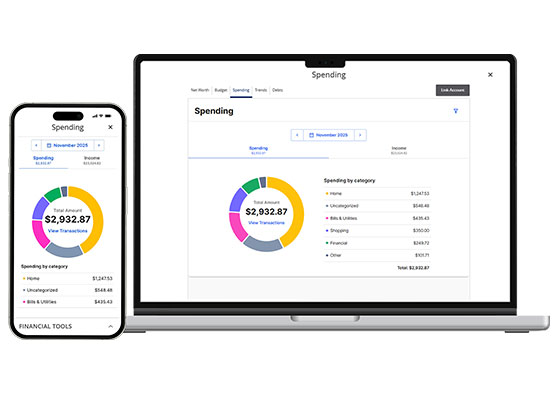

Personal Financial Management (PFM) Tool

Get the resources you need to make decisions with confidence. Track your spending, set budgets, monitor your net worth, and so much more!

Track Your Spending

Our budget and finances feature allows any of our members who have personal and/or business accounts to track their spending with a fully interactive, real-time dashboard for all your shares and categorizes transactions for easy budget creation.

Set Spending Targets

How do I Set Up the PFM Tool?

Log into Online Banking.

Desktop: Select any of the five widgets across the top of the homepage.

Mobile: Select Financial Tools, then click on Budget or Spending.

Agree to the terms and conditions.

All functionality available on the desktop PFM tool is also available via mobile—with the exception that only the Budget and Spending widgets have been optimized for smartphones.

PFM will categorize six months of transaction history upon enrollment.

Widgets are data visualization tools within PFM that allow you to easily access specific information about your finances.

Personal Financial Management (PFM) Tool FAQs

- Log in to your account via Online Banking or our Mobile Banking app. (Not enrolled in Online or Mobile Banking yet? Register for free now.)

- Select any of the five widgets across the top of the homepage if you're in online banking. If using the mobile banking app, choose Financial Tools, then Budget or Spending.

- Agree to the terms and conditions.