How Do I Lower My Auto Loan Monthly Payment?

A wise person once said that the only thing that is constant is change. Throughout the 5 financial stages of life, there are a lot of changes that happen. Changes to work, changes to friends, changes in family, and more. These events can sometimes mean a change of income, or a needed adjustment within your budget. The good news is that there are steps you can take to help reduce your auto loan monthly payment. Read on to learn how.

Your interest rate is only one factor with interest rate payments

It’s useful first to clearly understand loan terminology. Your interest rate is the percentage of your loan that you will pay in interest charges over the life of the auto loan. It’s a little different from your APR, which is the actual rate you pay with any additional sales tax or fees that were charged when you bought it. For example, if you currently have an auto loan with a 6% interest rate and a $400 annual fee, your APR is 6.4%.

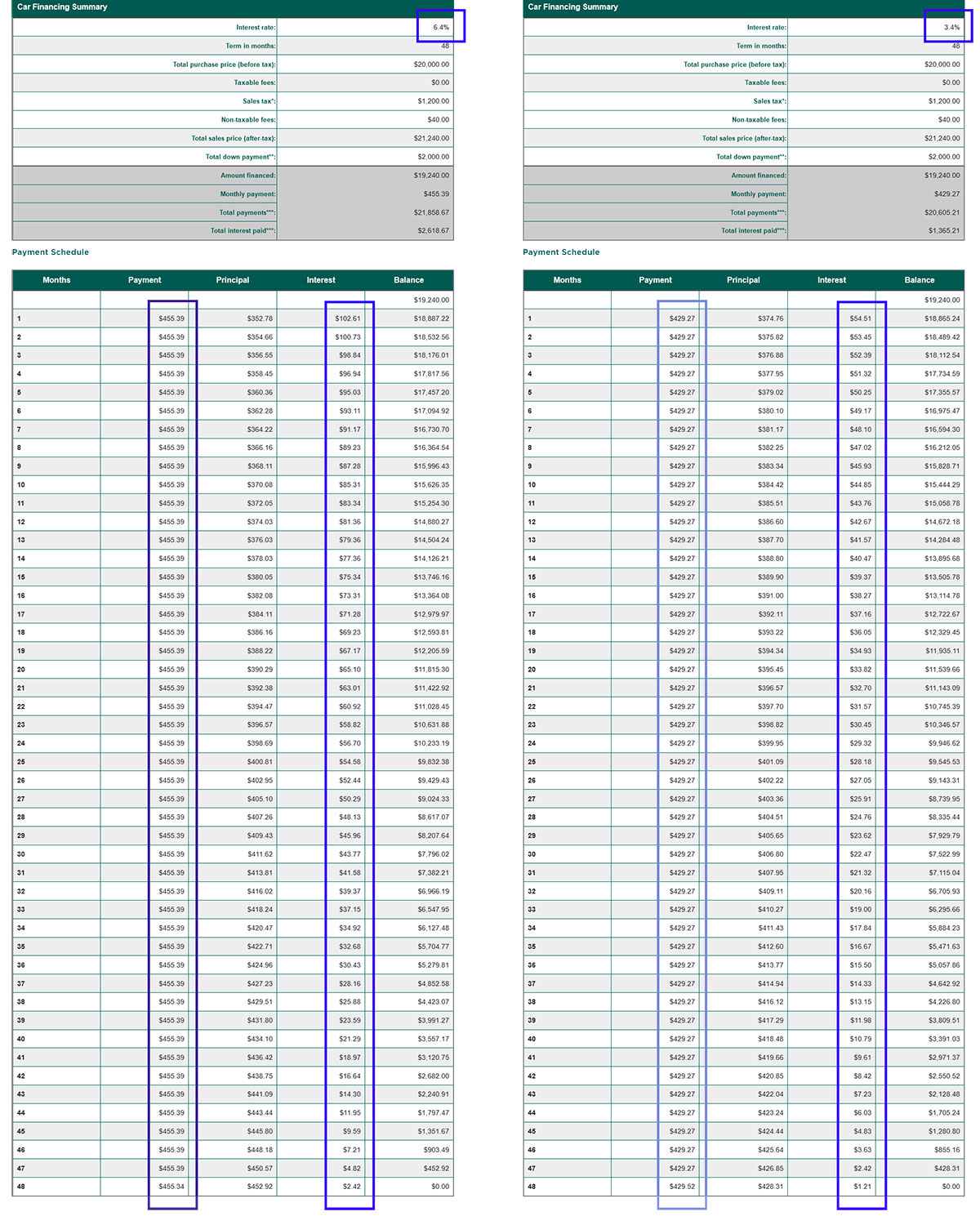

Your auto loan monthly payments, which are made over the term of the loan, include interest along with the payments to the principal. If your loan term is 48 months, then the interest during the first and second years would be much higher than the third and fourth years. That’s because there is more money owed on the car than in the beginning than towards the end. Here is an example to illustrate the difference in a $20,000 auto loan with an APR of 6.4% versus 3.4%:

Notice how the 3.4% auto loan on the right includes almost $50 less interest rate payment each month during year one than the 6.4% payment schedule. However, you can also see how there is only a $15 difference at the start of year four, after 36 loan payments have already been made. The primary driver of the overall monthly payment is the amount of principal remaining.

Ways to reduce your existing auto loan monthly payment

If you have a change in family income or large, unexpected expenses, the best strategies for reducing your auto loan monthly payment amounts focus on addressing the overall amount owed and the remaining term of the loan. Taking the balance and spreading it over a longer time period usually results in a lower monthly payment. Here are some options to consider.

Do you qualify for a lower interest rate? Start by checking your credit score to make sure it's in good standing. If it's not, you may want to consider taking steps to improve it so that you have more options. If your credit score has improved since you financed your car, you could qualify for a new loan with a lower rate.

Where did you finance your car or truck? Interest rates on auto loans are sometimes lower now than they were when the loan was originally taken out. That’s especially true depending on where you took out your loan. If you are able to take out a new loan with a lower rate with the credit union, you can use those proceeds to pay off the high-rate loan. That will save you money each month in interest and help bridge the gap in your finances.

Is your car or truck in good condition with low mileage? Another way to lower your auto loan monthly payment is to trade in your vehicle for a less expensive one. This will lower the amount you owe on your loan because the car or truck doesn’t cost as much as your previous vehicle, resulting in a lower payment each month.

Do you have a lump sum that can be used to pre-pay? You can also lower your auto loan monthly payment by prepaying your loan. This means making larger or more frequent payments than what is required, so that the loan is paid off sooner. That can certainly reduce the amount of interest you pay over the life of the loan.

Does this temporary income change make you a candidate for a refinance? It's important to keep in mind that not all lenders offer an in-house refinance option. And for those that do, there are infrequent approvals because of several reasons. A couple of these include rising or fluctuating interest rates, as well as limitations from different auto loan servicers. Before considering this option, ask yourself these important questions:

- Am I early or late into the loan’s term?

- Do I have record of a stable payment history for my car?

Conclusion

As you weigh the different approaches to substantially reducing your monthly payment, remember that we are there for you. Just reach out by calling 904.354.8537 so that we can discuss together how our team can best support you.

Learn More About Auto Financing

- How to Qualify for a Car Loan

- How Much Car Can You Afford?

- Is It Best to Finance with a Dealer, Bank or Credit Union?

- Loan Terminology to Know

- Factors that Affect Auto Loan Rates

- RV Financing in Florida